WELCOME!

Index Investing is on the rise. We sat down with leading fund selectors in New York to discuss how they are incorporating indexing into their portfolios

The Roundtable

Choosing the right index

Why do selectors pick one ETF rather than another? And how important is the underlying index for them?

The rise of ESG and index innovation

ESG is becoming increasingly important for all investors. How is the indexing industry responding?

Defining Smart Beta

Do index funds lend themselves to style boxes?

The Interviews

How to create an investable index

More markets, more sectors, more asset classes. Is there any limit to the number of indexes for investors to choose from? Is infinite choice a good thing?

The growing role of ESG in index investing

ESG investing is exploding and there’s no turning back. But can index investing really quantify what are essentially subjective and value-driven choices?

The future of index investing

Where will the index industry be in five years’ time? More assets of course, but where will they be invested?

The Infographics

The Supplement

Supplement

The growth of index investing has already changed the asset management landscape irrevocably and shows no signs of slowing. A glance at flow data for money going into actively managed versus passively managed funds will show you that. But index investing is about much more than just cheap access to the S&P 500 – it’s also about the creation of new innovative indices to deliver Smart Beta across a myriad of asset classes.

Supplement ezine

There are now some 3 million indices and 7,000 different index based products offering investors access to everything from multi-factor funds to fixed income and ESG. But is this all useful for investors? What do they actually want to see from index providers? Where is left to innovate? And how much are some of these funds being used?

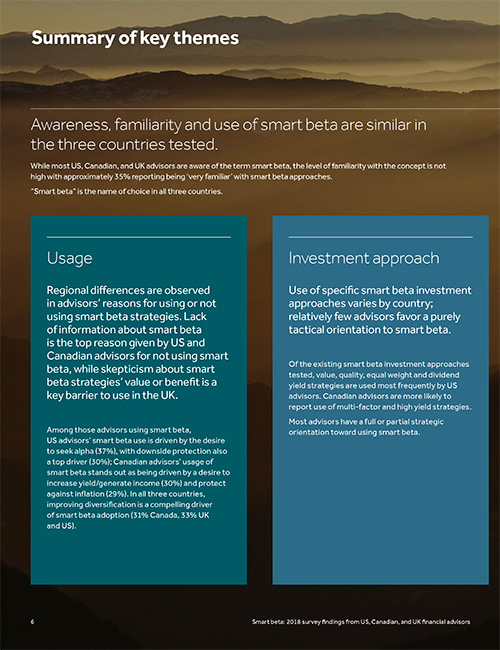

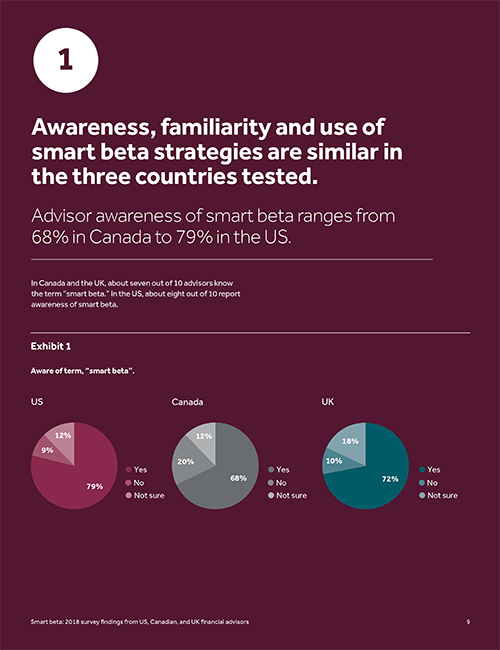

Smart Beta Report

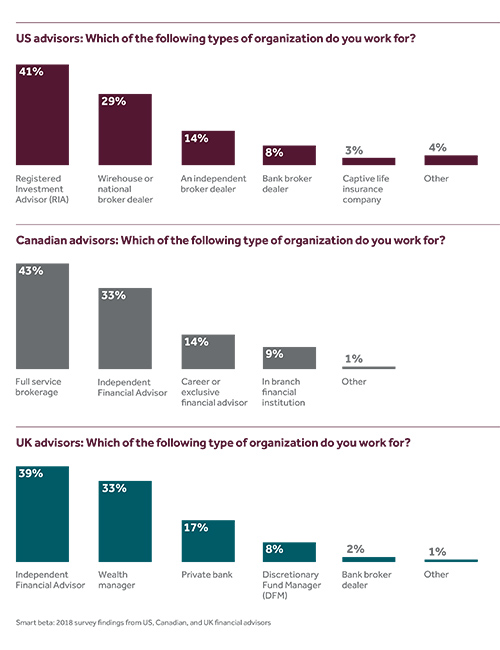

As part of our efforts to educate and inform investors, FTSE Russell is proud to present our recent survey of investment advisors’ interest and usage of smart beta. Our report collates over 250 responses from advisors working in the United Kingdom, Canada and the United States; follow the link below to discover what conclusions we can draw from these responses, and the insights that we hope will help advisors and their clients make better decisions to achieve their investment goals.

Contact FTSE Russell

FTSE Russell UK

10 Paternoster Square

EC4M 7LS

London

+44 (0) 20 7866 1810

FTSE Russell US